Insurance Law Tips

Navigating the complexities of insurance law requires a nuanced understanding of legal principles and strategic approaches. In this article, we explore essential tips for success in dealing with insurance law, providing valuable insights for individuals, businesses, and legal professionals.

Understanding the Basics of Insurance Law

Before delving into specific tips, it’s crucial to understand the basics of insurance law. Familiarize yourself with the fundamental principles, key terminology, and the legal framework governing insurance contracts. A solid foundation in insurance law basics lays the groundwork for effective navigation of more complex issues.

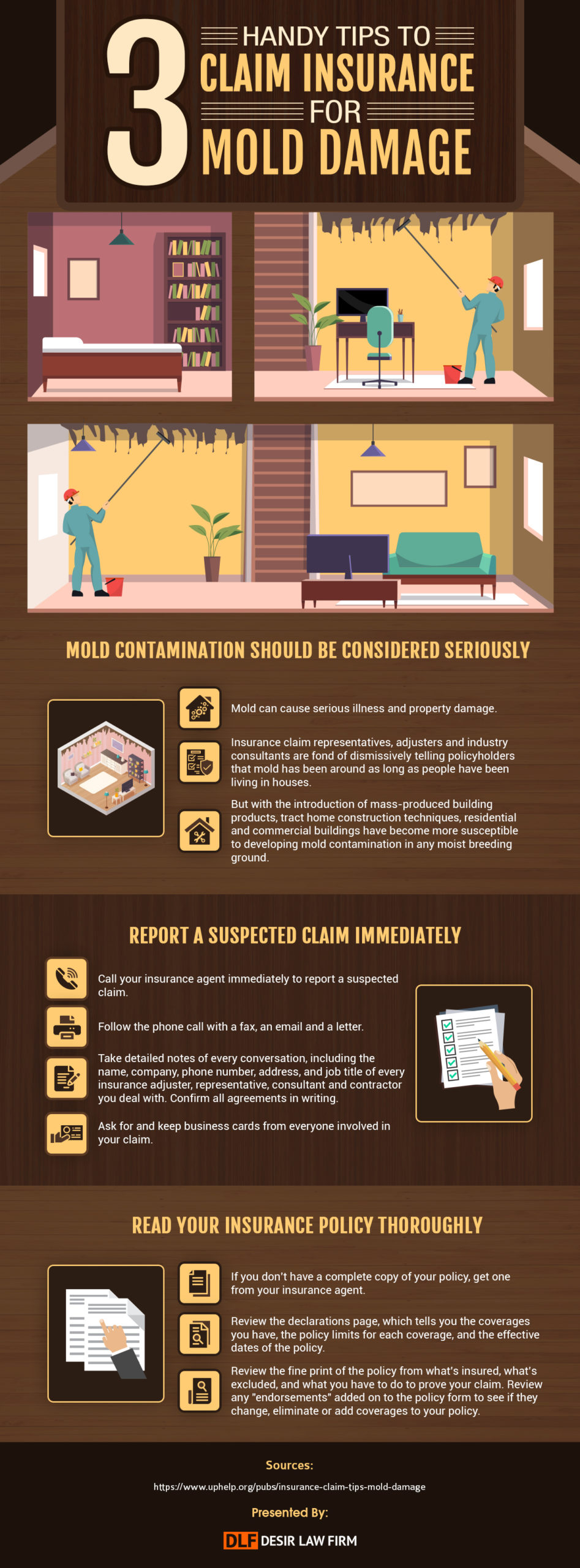

Thorough Review of Insurance Policies

A critical aspect of dealing with insurance law is conducting a thorough review of insurance policies. Whether you are an individual policyholder or a business entity, understanding the terms, coverage limits, exclusions, and conditions of your insurance policy is essential. A meticulous review ensures clarity on what is covered and what is not.

Prompt Notification of Claims

In the event of a loss or incident covered by insurance, it’s crucial to promptly notify the insurance company. Timely notification is a contractual obligation in most insurance policies. Failing to notify the insurer promptly may result in the denial of a claim. Prompt communication sets the stage for a smoother claims process.

Documenting Losses and Damages

Effective documentation is key when dealing with insurance claims. Thoroughly document losses and damages by taking photographs, recording statements, and gathering any relevant evidence. This documentation serves as vital support during the claims process, substantiating the nature and extent of the loss.

Understanding the Claims Process

Understanding the insurance claims process is essential for a policyholder. Familiarize yourself with the steps involved, from claim submission to assessment and resolution. Knowing what to expect helps you navigate the process more efficiently and ensures that you fulfill all necessary requirements.

Seeking Legal Counsel when Necessary

In complex insurance matters or disputes, seeking legal counsel is advisable. Insurance law can be intricate, and legal professionals specializing in this field can provide valuable guidance. Whether it’s interpreting policy language, negotiating with insurers, or litigating disputes, legal counsel enhances your ability to navigate challenges effectively.

Compliance with Policy Conditions

Strict compliance with the conditions outlined in the insurance policy is critical. Failure to meet policy conditions can result in claim denials. Pay attention to deadlines, reporting requirements, and any other conditions specified in the policy. Compliance strengthens your position during the claims process.

Regular Policy Reviews and Updates

Insurance needs evolve over time, and policies should be regularly reviewed and updated to align with changing circumstances. Whether you are an individual or a business, conduct periodic reviews of your insurance coverage. Ensure that your policies adequately reflect your current needs and provide sufficient coverage.

Consideration of Subrogation Issues

Subrogation is a common concept in insurance law where the insurer assumes the rights of the policyholder after settling a claim. Understanding subrogation issues is crucial, especially when dealing with third-party claims. Be aware of how subrogation may impact your rights and obligations in the aftermath of a loss.

Stay Informed About Legal Developments

Insurance law is subject to legal developments and changes. Stay informed about updates in insurance law, court decisions, and legislative changes. Keeping abreast of these developments ensures that your understanding of insurance law remains current and that you can adapt to any changes in the legal landscape.

For a more in-depth exploration of insurance law tips, visit Insurance Law Tips. This comprehensive resource provides additional insights and practical advice to further enhance your proficiency in dealing with insurance law. Incorporating these tips into your approach will empower you to navigate insurance-related matters with confidence and success.